If you’ve recently taken a more active role in your parents’ finances, you’re not alone. Many adult children are helping their aging parents with everything from paying bills to making healthcare decisions—and increasingly, protecting them from fraud.

Unfortunately, scams targeting older adults are growing in number and sophistication. Fraudsters prey on trust, isolation, and confusion, using tools like phishing texts, fake tech support calls, and realistic-looking emails. According to the FBI, financial losses among seniors are climbing at alarming rates.

The good news: with awareness and a few preventive steps, you can dramatically reduce the risk for the people you love.

How Big Is the Problem?

In 2024, consumers worldwide lost more than $1 trillion to scams (Global Anti-Scam Alliance). Over half of all consumers said they encounter fraud attempts at least weekly.

- Two in five adults over 60 have been victims of scams. Among those, nearly half lost money, averaging $3,590 per incident.

- Identity theft is especially damaging, with consequences that can linger for years. Victims may face ongoing credit issues, mounting legal fees, and in severe cases, the need for government assistance.

- Beyond financial harm, scams cause real emotional distress, shame, anxiety, and fear of losing independence.

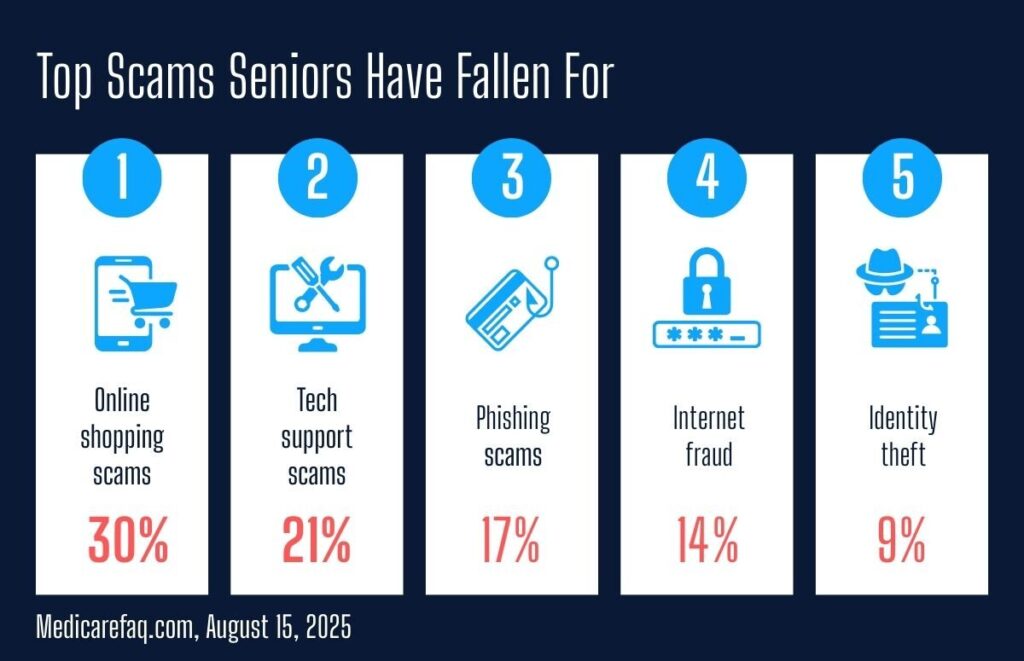

The Scams Seniors Fall For Most

1. Online Shopping Scams

Fake websites and sellers steal money or personal info.

✔️ Tips: Type in web addresses, use credit cards over debit, avoid “too good to be true” offers, and enable alerts.

2. Tech Support Scams

Pop-ups or callers pretend to be Microsoft/Apple, asking for remote access.

✔️ Tips: Legit tech companies won’t call you. Don’t click pop-ups or share passwords. Hang up immediately.

3. Phishing Scams

Emails, calls, or texts that impersonate trusted sources.

Common examples:

- Medicare scams – fake reps asking for personal info.

- Grandparent scams – imposters claim to be a grandchild in crisis.

- Sweepstakes scams – “you’ve won!” but fees are required.

- Government imposters – fake IRS or Social Security threats.

- Charity scams – pressure to donate after disasters.

- Bank scams – impersonators claim your account was hacked.

The AI Factor: Scams Are Smarter Than Ever

AI is making scams frighteningly realistic.

- Voice cloning – scammers mimic a loved one’s voice asking for money.

- Deepfakes – fake videos or audio of celebrities or officials.

- AI phishing emails – realistic, personalized emails that bypass spam filters.

The FBI warns these scams are on the rise and they’re hard to spot.

Why Scams Go Unreported

Many seniors never report scams due to embarrassment, fear, or confusion. Fraudsters know this, which is why older adults are often seen as “low-risk” targets.

Talking openly about scams helps remove the stigma and empowers your loved ones to act.

How to Protect Your Family

Here are simple, effective steps:

- Pause and verify. Always confirm unusual requests with a trusted family member.

- Stronger passwords. Use unique passwords and update them regularly. Consider a password manager.

- Use security tools. Antivirus software, spam filters, MFA, and VPNs add protection.

- Limit online sharing. Less personal info = fewer targeted scams.

- Check accounts often. Review bank and credit card statements regularly.

- Freeze credit files. Prevents criminals from opening new accounts.

- Register with the Do Not Call Registry. Cuts down on scam calls.

- Enable fraud alerts. Most banks and credit cards can notify you instantly.

- Add a trusted contact. Financial institutions can reach out to a trusted person if fraud is suspected.

Final Thoughts

Fraudsters are getting more sophisticated, but you can stay one step ahead. A few conversations, smarter habits, and the right tools can go a long way toward protecting the people you love.

💡 Start today: talk with your family, review their security habits, and set up simple protections like alerts and password updates.

If you have questions or need guidance, don’t hesitate to reach out—we’re here to help.