Estate Organizer with your Living Trust, Will,

Durable Power of Attorney, Medical Directives

Protect Your Peace of Mind Today!

Eliminate family fighting

Ensure your wishes are achieved!

Stay in control after you are gone!

Protect yourself and your loved ones with this limited-time offer.

“People Don’t Plan to Fail, they Fail to Plan”

$1,499 Now Only $799!

“This program was created with the help of my Estate Attorney, Margaret.

These are the same documents that protect me.”

Limited-Time Offer

Buy Today & Save!

This Trust Kit

Includes All 4 Must Have Documents

Living Trust

Durable Power of Attorney

Pour Over Will

Medical Directives

Plus, Get This FREE BONUS:

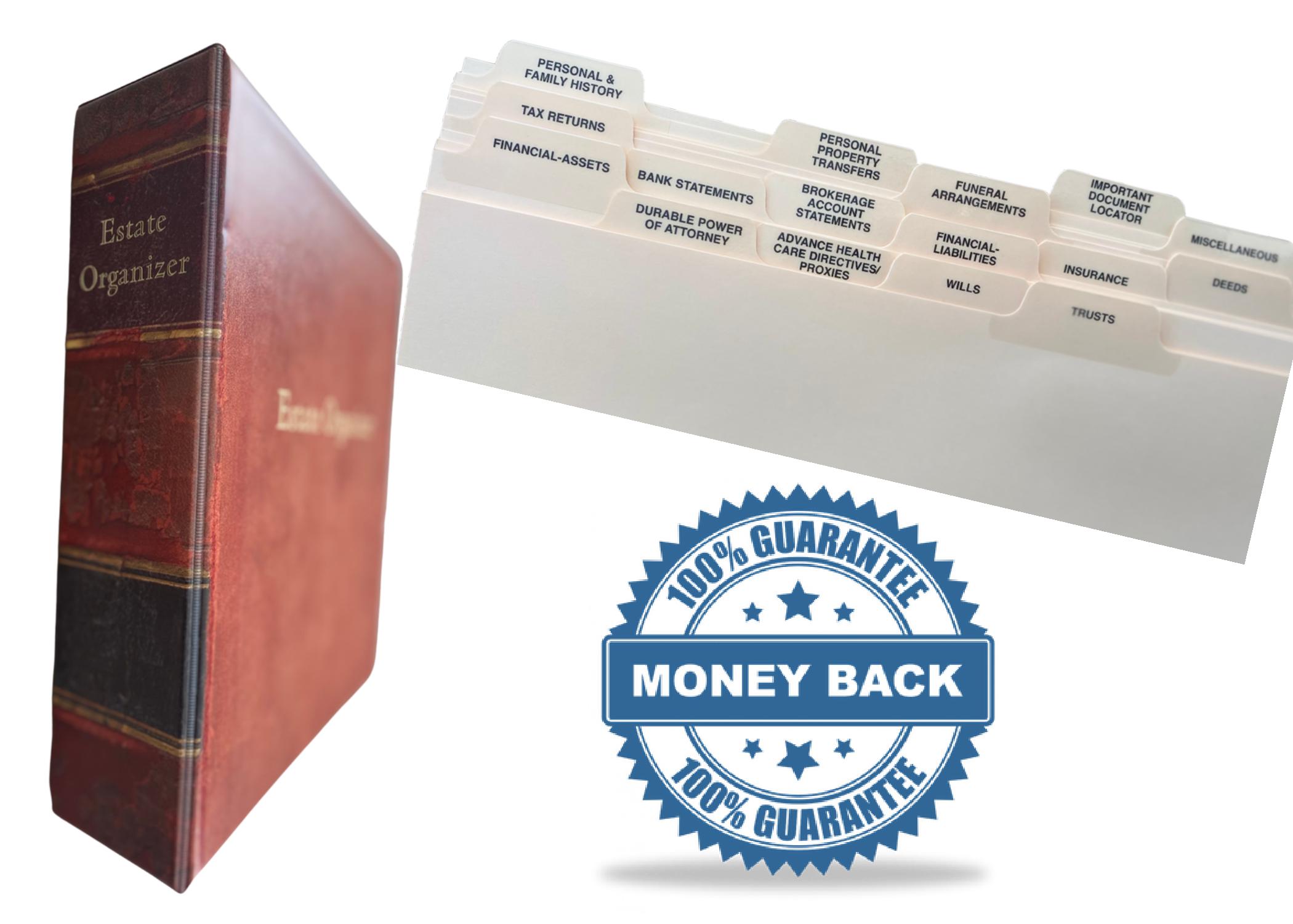

Estate Organizer ($29.95 Value)

Here’s How It Works:

Step 1: PERSONALIZE

Fill in the questionnaire, and the program will automatically send it to our office, and we will begin creating all of your 4 must have documents.

Step 2: PREVIEW

Within 48 hours our office will email you all of your documents to review and check for spelling. It doesn’t get any easier.

Step 3: PAY and PROTECT

You will pay and we will mail out all of your printed documents, your beautiful Estate Organizer, along with the instructions showing you where to sign, notarize if needed and anything else you must do to make sure your documents are complete. Congratulations! Now, all you have to do is keep your completed documents in a safe place.

It really is as simple as 1-2-3

Let me tell you why you need

your must have documents

Estate Organizer with your Living Trust, Will, Durable Power of Attorney, Medical Directives

Will

Living Revocable Trust

Durable Power of Attorney for Health Care

Financial Power of Attorney

Easy to Navigate Questionnaire

4 Customized Legal Documents

Update Anytime At No Additional Charge

Mobile-Friendly

Legal in all 50 States

Free and Automatic Legal Updates

Join the thousands of people with peace of mind that when you are gone or incapacitated that you are still in control of your finances, and all that is important to you.

A $3,500 Value! You can’t afford to miss out on this offer.

Hear what others are saying

Great Peace of Mind

The biggest compliment someone can give is a recommendation. When we asked for a recommendation for a financial advisor Suzanne came highly recommended. We have been putting off getting my house in order for way too long. We are kicking ourselves for not starting earlier. Suzanne walked us through the process. From our family trust to our retirement. Suzanne gave us peace of mind. We cannot thank her enough.

Amazing, quick and easy process

I have been so happy working with you! You have been so helpful, knowledgeable, and eager to help. You have made this process so smooth, and I really appreciate it. I have recommended you to many of my friends and will continue to do so!

Thank you again Suzanne for your amazing help with our family trust!

Easy to complete, saved us thousands

Easy to understand and complete, highly recommend. We were able to put our home in a living trust, list who we wanted to have what to avoid family fighting, get the documents notarized and now we have great peace of mind. Saved us over $2,500.00 in attorney fees.

Frequently Asked Questions:

What is a Revocable Living Trust?

Let’s take this word by word:

Living: A trust is effective during your lifetime. As soon as you pass away, it receives a tax identification number and stays effective until your wishes are achieved or 99 years, whichever comes first.

Revocable: Everything you state in the trust can be changed. At any time. That’s what revocable means. So relax. This is a legal document that you can change as your life changes.

Trust: An entity, which is a thing with distinct and independent existence. Once you create a trust you can move the ownership of key assets –such as a home and other property – into the trust and appoint yourself as the trustee, meaning you call all the shots on how to use and manage those assets while you are alive. You also appoint someone to be your successor trustee. If you become incapacitated, the successor trustee can step in easily and manage your affairs. Or, when you die, the successor trustee takes over without the need to get any court approval.

What is a Pour-Over Will?

Also, while your big-ticket assets, such as a home, should be owned by your trust, you likely have other smaller keepsakes –a china collection, watches etc. – that you want to give to a specific person. You can put these on Schedule A in your Trust, but in case you did not, a pour-over will is the legal document that states where you want these assets to go after your death.

If you have young children, you must, must, must have a will. A will is where you appoint a guardian for minor children, and pets. I realize thinking about this can be upsetting, but let’s talk about something even more upsetting: if you die without a will that establishes your children’s’ guardians, decisions about the care of your kids are going to fall to the court system. That’s what happens when parents die without a legal guardian ready to step in. Sure, a sibling or cousin or dear friend might end up as the guardian, but only after a draining court process, and potentially ongoing court oversight.

Why are Medical Directives also called Durable Power of Attorney for Health Care?

Without Medical Directives in place, you are potentially creating a difficult situation for your family if there are disagreements on care. What a horrible time for them to be arguing. By having Medical Directives, you are telling your family: “This is the person who I have chosen to make the decisions.” That also will help your medical team. Being able to get quick clear guidance from the medical directives, rather than having to navigate family fighting, can speed up your treatment.

What is a Durable Power of Attorney?

In the event you ever need help managing those accounts while you are alive, a durable power of attorney is the official document that gives someone you appoint the authority to step in.

A durable power of attorney document is also going to smooth out having someone help you manage other accounts. Utility companies, credit card issuers, the management company for your lease, won’t share information with anyone not named on your account. With this document your appointed representative will be able to easily step in and help manage your affairs.

Whether it is a sudden illness such as the coronavirus or the onset of dementia later in life, a durable power of attorney is such an important step to protect yourself from financial issues.

What is the difference between a Trust and a Will?

One of the differences between a will and a trust is when they kick into action.

A will lays out your wishes for after you die. And has to go through probate, which costs thousands of dollars and many months, sometimes years to settle.

A living revocable trust becomes effective immediately. While you are alive you can be in full charge of your trust. And when you become incapacitated or die, the person you appoint as the successor trustee can easily step in and handle your affairs exactly as you have laid out in the document.

You love your family more than anything, right? Having both a trust and pour-over will is a powerful way you show your love. It will save your family time and money. And the heartache of squabbles if you were to die and not leave clear instructions on who is to get what.

Do I need a Trust if I am not wealthy?

It is important to understand that if you only have a will, when you die your family will have to go through a lengthy court process to have the right to follow what you laid out in your will. This is called probate. In addition to being time-consuming and costly (they will need to hire a lawyer) it is also public. When you die with only a will, that document must be filed with the court, and can be accessed by anyone.

The surest way to avoid probate is to have a trust. A living revocable trust does not need court approval. Everything stays private, and your successor trustee can take over its management immediately upon your incapacitation or death.

Phoenix Financial Group, LLC is providing services at your specific direction. We are not a law firm or a substitute for an attorney or law firm. We cannot provide any kind of advice, explanation, opinion, or recommendation about possible legal rights, remedies, defenses, options, selection of forms or strategies.

© 2024 Phoenix Financial Group, LLC All rights reserved.

Privacy Policy

CUSTOMER CARE

(844) 476-7753

Monday – Friday

8:00 am – 5:30 pm CT

Disclosure:

Suzanne Porske is an Investment Advisor Representative, advisory services are offered through Aegis Wealth Management, Inc. The firm is registered as an investment advisor with the SEC and only conducts business in states where it is properly registered or is excluded from registration requirements. Registration is not an endorsement of the firm by securities regulators and does not mean the advisor has achieved a specific level of skill or ability. The firm is not engaged in the practice of law. Phoenix Financial Group LLC and Aegis Wealth Management Inc are unaffiliated entities

Page Created by Done For You Technology![]()