As summer approaches, your thoughts may drift toward escaping your daily routine. Whether your idea of a perfect vacation is sitting on a pristine beach, fishing in a mountain lake, or playing the back nine between pickleball matches, many of our clients have come to us over the years with the same question—should I buy a vacation home or just continue to rent?

As financial professionals, our answer is, “It depends.”

Renting a house for a week or two can be less expensive and time-consuming than buying a vacation property. Renting is a short-term commitment, while buying a second home often requires an ongoing investment of time and money. Renting allows you to choose different vacation destinations every year without maintenance and upkeep concerns. However, buyers can decide to rent out the property when they’re not there.

We caution our clients to consider the pros and cons before making decisions. While we aren’t real estate experts, we’ve compiled some information that you may find helpful.

Buying A Vacation Home

- Non-Financial Considerations

Many financial considerations must be pondered with a vacation property. Will you buy it outright or take out a mortgage? Are you interested in renting it when you’re not there? Will it impact your cash flow? There are also many nonfinancial issues you may want to consider, the most important being how a second home will affect your lifestyle.

Here are a few more aspects to consider before signing on the dotted line:

- How Much Time Will You Spend There?1

If you only intend to spend a few weeks a year there, is renting a better choice? The expense and hassle of owning a second home may not be worth it unless you stay a few months each year to enjoy the place. Over time, you can develop friendships and become part of the community, making your second house more of a home. - How Does a Second Home Fit Into Your Travel Patterns?1

By owning a vacation home, you may spend less time traveling to other locations. Consider whether focusing vacation time on one location fits your desired travel patterns. For example, if you believe you’ll be happy spending all your free time in Florida, then buying may be right for you. However, you may feel tied down to one place if you like to travel the world. - Will a Second Home Increase Your Stress?1

Before buying, be aware of the potential stress of owning a second home. Like your primary residence, you’ll need to deal with utilities, maintenance, repairs, and other considerations. While you may find these issues worth the benefits of owning a vacation home, you should enter ownership with your eyes wide open. - Will Purchasing a Vacation Home Enhance Your Experiences and Relationships?1

If your vacation home becomes a hub for family and friends to visit and for you to engage in social activities and adventures with them, owning a second home can increase your happiness. Clients who enjoy their vacation homes the most tend to create memories through experiences with family and friends at their second homes. On the other hand, buying a vacation home primarily as a relaxing retreat may not add much to your overall happiness—despite the weather and scenery. - What Are the Potential Advantages of Buying a Vacation Property2

There are many good reasons to buy a vacation home. After considering the aforementioned nonfinancial factors, it may be the right course of action for you and your family. Here are some potential benefits:

- Possible Real Estate Appreciation: One potential advantage to buying a vacation property is that the value of the real estate may increase over time. Of course, there are no guarantees, and your property could lose value.

- Renting Costs for Your Vacation: Owning a property in a vacation spot means you won’t need to pay for weekly accommodations.

- Perhaps Generate Rental Income: Another benefit to buying a vacation property is the opportunity to generate rental income. If you choose a vacation home in a bustling short-term rental market, you may have the chance to rent out your place when you’re not in town.

- Convenience: Owning a vacation home can be more convenient than arranging short-term rentals. It’s also more familiar, comfortable, and allows you to host friends and family.

- Retirement: A vacation home can be part of your retirement strategy. Some clients have used their second homes in later life and moved in permanently.

- Possible Real Estate Appreciation: One potential advantage to buying a vacation property is that the value of the real estate may increase over time. Of course, there are no guarantees, and your property could lose value.

Potential Disadvantages of Buying a Vacation Property

Of course, where there are pros, there are cons. While we don’t want to rain on anyone’s parade, as financial professionals, we strive to provide a fair and balanced view. So, here are some of the potential downsides of buying a vacation property:

- Money Management: Buying a property can be costly, especially a second home in an expensive vacation area. In addition to initial costs, there are also ongoing maintenance and other costs. If money is an issue, buying another house may not be your best choice.2

- Financing: If you cannot self-finance your purchase, financing a vacation home can be challenging because of different mortgage requirements. A higher credit score and a larger down payment are often required to qualify for a mortgage. So, if you are not paying in cash, expect a more complicated financing experience than purchasing a primary residence.2

- Property Management: If you plan to generate rental income when you’re not using your vacation home, you may want to hire a property manager to find renters, collect rent, and clean the place. This could add up to 15% of the rental income.2

- Inconsistent Rental Income: Rental income often depends on the season or certain times of the year. There are usually seasonal periods when no one might rent. Vacation property rental income is impacted directly by the destination and its popular times, which can affect income.2

- Lack of Disaster Aid: FEMA disaster assistance is limited to your primary home, i.e., where you live for more than six months out of the year. Second homes or vacation homes used as vacation rentals don’t qualify for FEMA assistance. Thus, if hurricanes, wildfires, or floods destroy or damage your second home, you must rely on other options.3

Markets for Luxury Second Homes

While demand for luxury second homes rose during the pandemic, you may think that today’s relatively high interest rates, tight inventory, and uncertain economic environment would’ve damaged the market. They haven’t.4

Despite the numerous challenges hitting residential real estate, the luxury housing market has remained strong. According to The Agency’s 2025 Red Paper, the number of U.S. homes selling for $1 million-plus increased by 5.2% in the first half of 2024, while the median price for high-end properties rose by 14.2%. Compared with the broader market, in which overall home sales fell by 12.9%, the median price increased by just 5% over the same period.4

With more cash on hand and fewer financial constraints, wealthy homebuyers are often less reliant on loans. According to The Agency’s report, homebuyers paid cash for nearly half of all luxury homes sold in the first quarter of 2024.4 So, if you’re in the market for a high-end second home, you’re in good company.

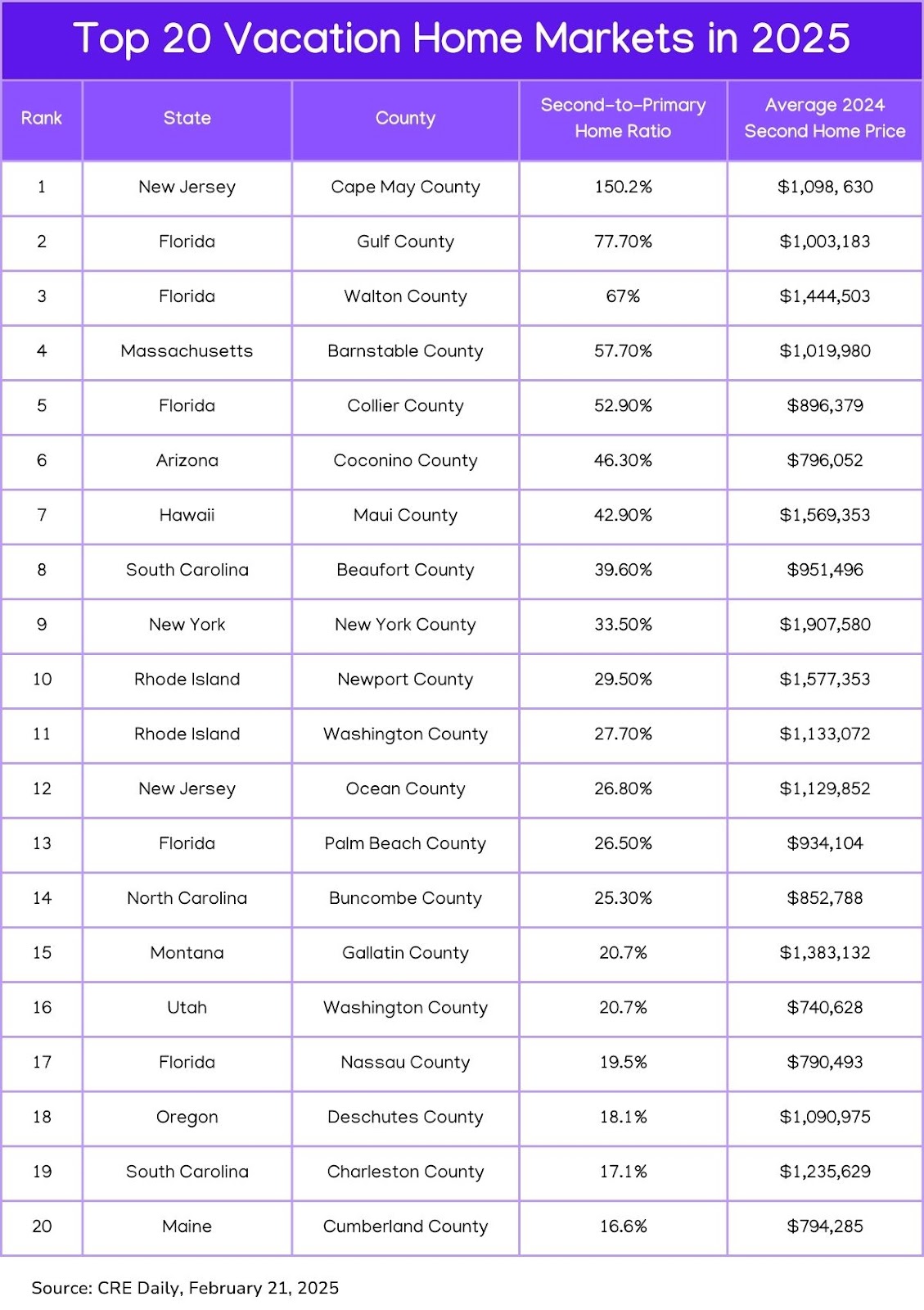

Real estate company Pacaso analyzed the markets with the most significant year-over-year growth in luxury second-home transactions from 2023 to 2024 and average prices for second homes. They believe these second-home destinations could see more growth this year.4

As you’ll see in the chart below, Cape May County, New Jersey, with its Victorian charm and sandy beaches, ranked as the top spot for second home purchases in 2025, with Gulf County, Florida, coming in as a distant runner-up.4

Suppose you’re looking for a second home selling at under $1 million. Washington County, Utah, near Zion National Park; Coconino County, Arizona, near Flagstaff; and Cumberland County in south-central Maine along the coast are popular locations.4

Insurance Considerations for Second Homes

Unless you have the resources to “self-insure,” you might want to consider homeowners insurance to protect your real estate purchase. Second home insurance is a specialized policy designed to cover properties that are not your primary residence. Policies differ because a second home may have additional risks not associated with your primary residence.

Standard homeowners’ insurance for a full-time residence costs an average of $1,754 per year, but you might pay more for a second home insurance policy. For example, American Family estimates that vacation home policies are typically two to three times more expensive than home insurance for a full-time residence.5

The additional risks that cause second home insurance to be higher include:6

- Vacancy Periods: Unoccupied homes are more vulnerable to theft or damage.

- Location-Based Risks: Coastal or mountainous properties may face specific hazards like hurricanes, floods, or wildfires.

- Higher-End Property: If your second home is a luxury property, consider high-value property insurance.

- Rental Use: If you rent to others, you may face additional liability concerns, such as tenant-caused damages and liability for injuries sustained by renters or their guests.

Banks will require that your second home be insured if you take out a mortgage. If you are paying cash, the insurance coverage you want, if any, is up to you. If you seek coverage, you should evaluate risks, compare providers, and determine if the policy aligns with your needs and property usage.

Including a Vacation Home in Your Estate

If you buy a vacation home, consider what happens to the property after you’re gone. If a family vacation home is part of your estate, you should put the time and effort into outlining your intentions for the next generation. Your heirs should know what they’re getting and the time, effort, and resources they’ll need to put into the property to keep it functioning well. You know your family’s dynamics and that not all of your heirs will have that same level of interest or involvement in the family vacation home. Thus, be mindful of this and flexible when creating your strategy.7

Consider working with your financial professional and estate team to determine the best way to transfer your vacation home based on your situation. Here are a few choices you may want to evaluate:7

- Sell the house outright or gift it to one or more of your children.

- Establish a trust in which one or more trustees are responsible for owning and maintaining the property. Using a trust involves a complex set of tax rules and regulations. Before moving forward with a trust, consider working with a professional familiar with the relevant rules and regulations.

- Form an LLC or other legal entity where your heirs will be owners and follow specific governance rules and operating agreements in how the property is used.

As financial professionals, we can offer insights into how your vacation house may contribute to your overall estate strategy.

Tax Implications of Owning a Second Home

As we mentioned before, we’re not tax experts, but we work with people who are. We’re outlining some general information, but it’s not a replacement for real-life advice. Consult your tax, legal, and accounting professionals for more specifics regarding your second home.

If your second home is a residential home, you may be able to deduct mortgage interest up to $750,000 as long as the second home is the one that secures the loan. If your mortgage on your second home originated before Dec. 16, 2017, you can deduct up to $1 million in mortgage interest. You also can deduct state and local property taxes––up to $10,000 combined for all real estate taxes between your homes.8

If you rent your property for 14 days or less during the year, you may not need to report this as income to the IRS.8

If you rent your second home for more than 14 days a year, the IRS considers it an investment property. If your second home is an investment property, you might be able to deduct mortgage interest or real estate taxes on your personal income tax return. Still, you may be able to deduct those costs against your rental business income.8

When you sell your second home, you must be aware that you may not receive the same capital gains tax deduction when selling your primary residence – $250,000 for single filers and $500,000 for married.8

Renting a Vacation Home

If you have gone through all the pros and cons of buying a vacation home and are leaning toward renting, this approach also has two sides. Let’s start with the positives.

Potential advantages of renting a vacation home2

- Little Responsibility: If you choose to rent a vacation home, your only responsibility is to leave the house the same way you found it. None of the property maintenance or utilities fall onto a short-term renter to take care of, which means you can enjoy your holiday and then dump your garbage on the way out, turn out the lights, and lock the door behind you.

- Variety of Options: Renting vacation homes means renting a different home anywhere you go. You won’t be limited to revisiting the same place over and over. Instead, you can change locations each time you go on vacation and experiment with the type of property to see what you enjoy best – in town or out, kid-friendly or over 55, nightlife or peace and quiet, etc.

- Cost Considerations: Renting a vacation home can be a more affordable way to go on various vacations in many areas. After all, you will not pay a mortgage, maintenance fees, or other charges.

Disadvantages of Renting a Vacation Home

Anyone who has rented a vacation home knows that there are some downsides. Here are a few of them:

- Cost: In 2024, the expected average daily rate for U.S. vacation rentals is $326.9 This number will fluctuate based on the type of home you rent. A luxury rental could be significantly higher.

- Not Your Space: When renting a vacation property, you live in someone else’s home. For many people, it’s never as comfortable as staying in a place you own. You may find problems with the house, it may not have all the features you are accustomed to, and you may need a learning curve to figure out how to use everything from the TV to the thermostat.2

- Availability: You may need to book your vacation homes well in advance during peak seasons. Chances are you want to go away at the same time of year, but others have the same idea. Availability can be problematic if you book too late or the area is extremely popular.2

- Inconvenient: Renting a vacation home can be a hassle. You have to choose the home, make sure it’s available when you want, and then go through the booking process with the owner, the property manager, or a third-party website. If anything accidentally breaks during your stay, you’ll also be liable to cover it. There can also be unexpected fees that drive up the price.2

Make Your Decision Carefully

I’m sure you’ve gone on vacation to a terrific location and fallen in love with it. The experience might have been so wonderful that you thought about buying a home to spend more time there. That’s how the time-share industry became so popular in the 1970s and 80s—catering to impulse buyers.

However, it’s important to remember that while you might be swayed by the most enjoyable aspects of your vacation, you should consider the negative factors that owning a second home can bring. Between costs, extra work of taking care of another property, and the impact on your other travel habits, owning a vacation home can have drawbacks. You also may want to factor in how being away could impact your relationships back home.

Before you commit to buying a vacation property, you might want to consider living there for a month or two first. Spending an extended amount of time in a rental property at your intended vacation home location may provide you with a more realistic view of the area.

There is no right or wrong answer on whether to buy or rent a vacation home. Please take the time to weigh the pros and cons thoroughly before deciding. Please do not hesitate to contact us if we can help or just be an impartial sounding board.

Sources:

1. Forbes, May 31, 2024

https://www.forbes.com/sites/johnjennings/2024/05/31/is-a-vacation-home-right-for-you-key-factors-to-consider-before-you-buy/

2. New Silver, January 25, 2024

https://newsilver.com/the-lender/buy-a-vacation-home-or-rent/

3. FEMA, August 30, 2024

https://www.fema.gov/fact-sheet/questions-and-answers-federal-assistance

4. CRE Daily, February 21, 2025

https://www.credaily.com/briefs/the-top-luxury-second-home-markets-to-watch-in-2025/

5. Policygenius.com, May 7, 2024

https://www.policygenius.com/homeowners-insurance/second-home-insurance/#how-much-does-second-home-insurance-cost

6. Coughlin Insurance Services, January 2, 2025

https://coughlinis.com/second-home-insurance-what-you-need-to-know/

7. U.S. Bank, February 2025

https://www.usbank.com/wealth-management/financial-perspectives/trust-and-estate-planning/estate-planning-for-vacation-homes.html

8. MSN, January 3, 2025

https://www.msn.com/en-us/money/realestate/second-home-taxes-explained-what-owners-need-to-know-in-2025/ar-BB1k1mJF

9. PhotoAiD, February 14, 2025

https://photoaid.com/blog/vacation-rental-statistics/