Despite the noise, history often rhymes. Here’s why sticking to proven investment principles may still be your best strategy in 2025.

Why “This Time It’s Different” Can Be Costly

Sir John Templeton famously warned: “The four most dangerous words in investing are: ‘This time it’s different.’”

Many voices in 2025 claim that traditional investing rules no longer apply. But history tells us otherwise.

Since 1980, the S&P 500 Index has experienced an annual drawdown greater than 5% every year except 1995 and 2017. Even so, the market still ended positive in 75% of those years.

📉 Average intra-year drawdown (1980–2020): -13.7%

📈 Long-term average return: +10.5% annually since 1957

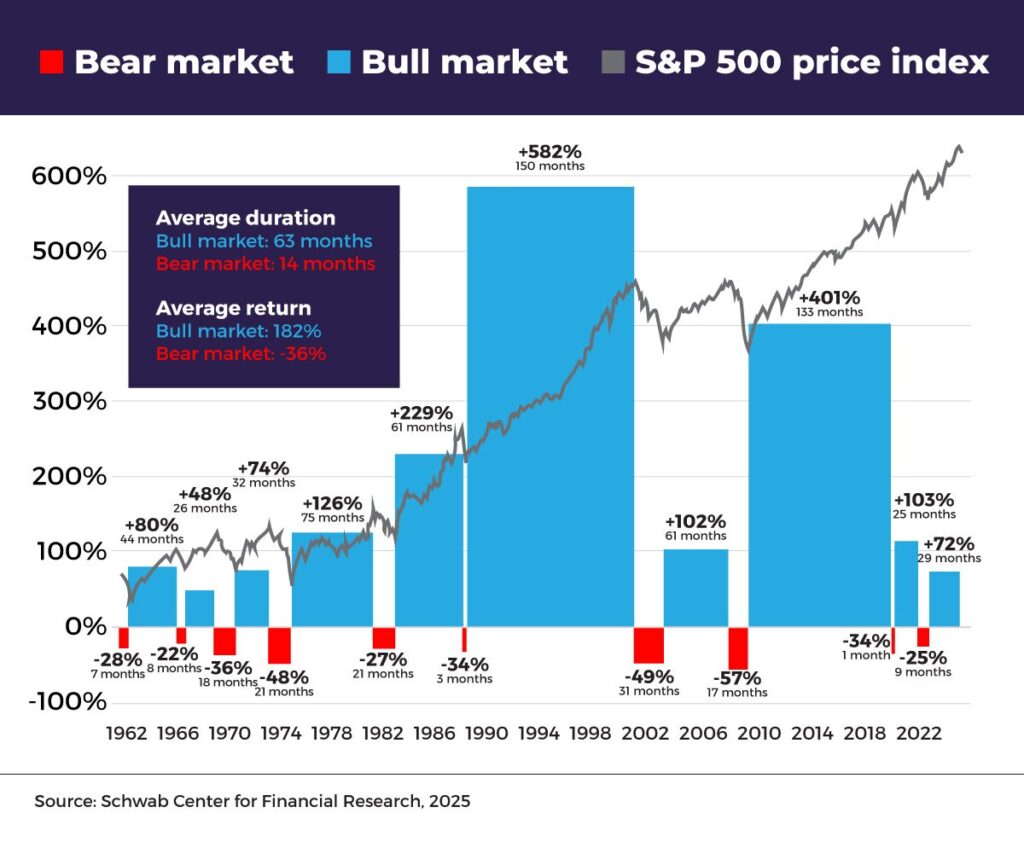

Market Corrections Are Normal

Pullbacks, even steep ones like during the COVID-19 crash in 2020, are a natural part of market cycles. The S&P 500 dropped over 30% in early 2020—but rebounded to new highs within six months.

These corrections should be expected, not feared. In fact, they often create buying opportunities for disciplined investors.

Long-Term Investing Wins

Market returns over time:

- 1-year range: –37% to +53%

- 5-year range: More stability, fewer negative outcomes

- 20-year range: Historically always positive, ranging from +0.5% to +13.2% annualized

⏳ Lesson: The longer you stay invested, the better your odds of success.

What If We’re in a Bear Market?

Bear markets are shorter-lived than bull markets.

Don’t Miss the Market’s Best Days

Trying to time the market is risky.

- 78% of the best days happen during or shortly after bear markets

- Missing just the 10 best days over the past 30 years halves your return

- Missing the 30 best days erases 83% of potential gains

📊 Stay invested. It’s time in the market, not timing the market, that matters.

Consider Dollar-Cost Averaging

This strategy involves investing equal amounts at regular intervals, regardless of price.

- Helps manage volatility and emotions

- Useful during uncertain times

- Not guaranteed to outperform, but encourages discipline

Alternative: Lump-sum investing, which statistically outperforms dollar-cost averaging 75% of the time over 10-year periods.

👉 Tip: Consult a financial advisor to determine what’s best for your goals.

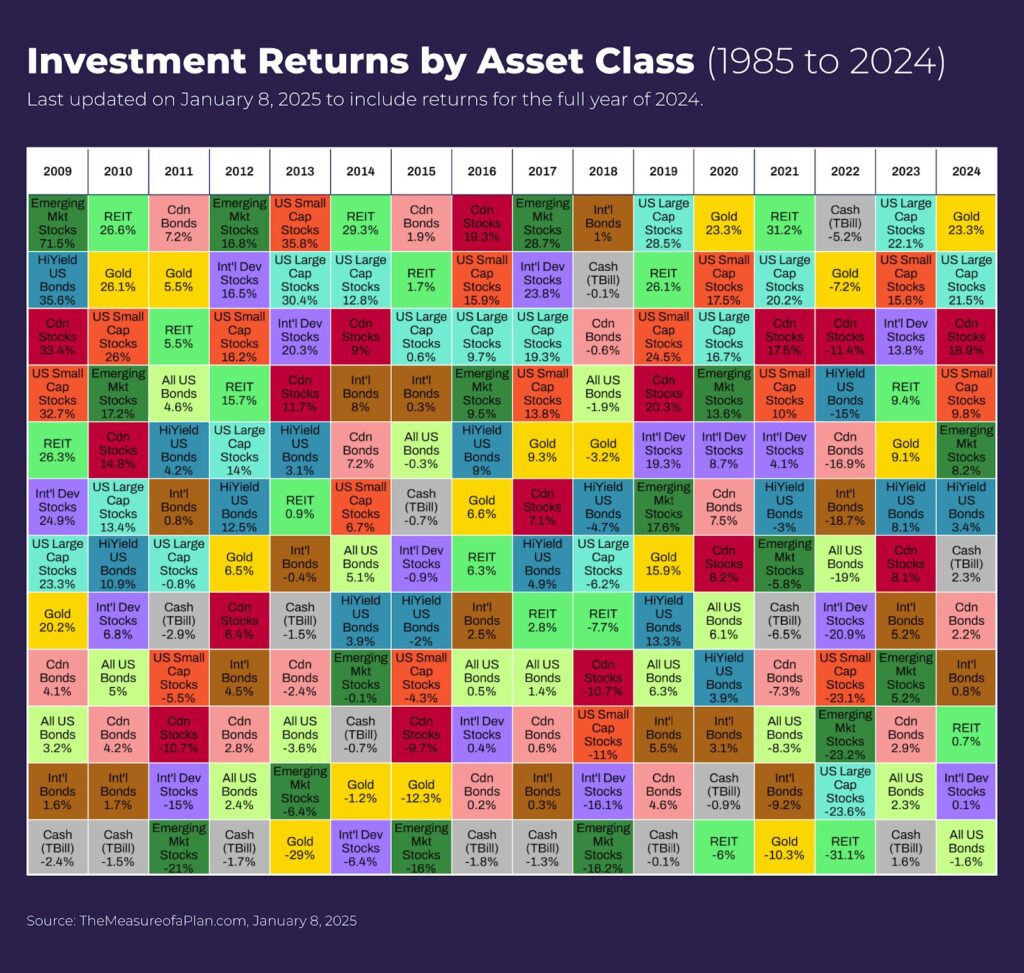

The Importance of Diversification

Diversification helps reduce risk by spreading investments across:

- Asset classes (stocks, bonds, real estate, commodities)

- Regions (U.S., international)

- Investment styles (growth, value)

From 1985 to 2024, nine different asset classes were top performers in various years—and six different classes ended at the bottom.

🔄 Diversification doesn’t eliminate risk—but it manages it.

What Should You Do Next?

📌 Stick to Your Strategy

A diversified portfolio is built to endure turbulence.

📌 Manage Withdrawals

Avoid pulling out during down markets if you can. Let your capital work for you.

📌 Focus Long-Term

History rewards investors who stay the course and avoid emotional decisions.

Final Thought: History Is On Your Side

Despite wars, recessions, and crashes, the S&P 500 has delivered 10.5% average annual returns since 1957. Those who stayed disciplined were rewarded.

If you’re concerned about your portfolio or want a second opinion, we’re here to help.

📞 Contact us today to schedule a free investment consultation.