You’ve worked hard throughout your life to build assets to support your retirement. As financial professionals, one of the most critical functions we provide is helping clients determine their retirement income needs and structuring a withdrawal strategy that works for them. But you can’t develop a comprehensive strategy without knowing where all your assets are, including any “lost” 401(k) accounts you may have forgotten.

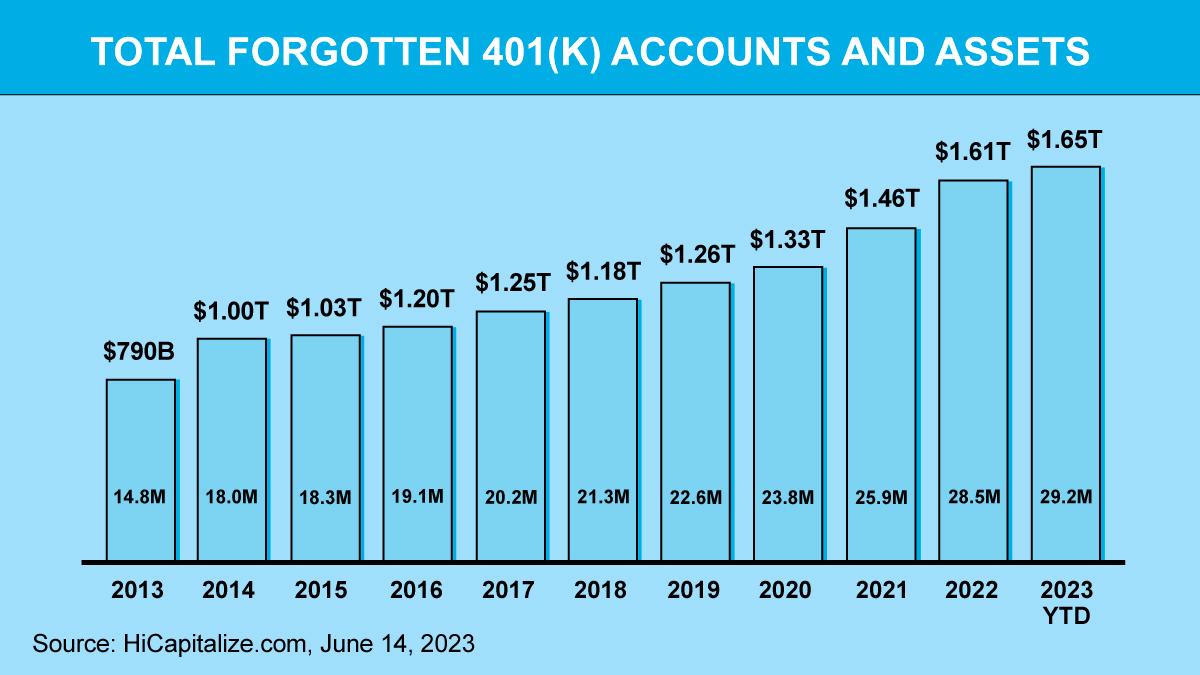

Surprisingly, losing track of an old 401(k) happens more often than you might think. As of May 2023, there were over 29 million “left-behind or forgotten” 401(k) accounts in the U.S., holding nearly $1.65 trillion in assets.1

Whether or not the balance of a forgotten account is large, no one wants to “leave hard-earned money on the table.”

Multiple jobs could mean multiple retirement accounts

It’s easy to understand how 29 million accounts were left behind. According to the Bureau of Labor Statistics, Baby Boomers born between 1957 and 1964 held an average of 12.4 jobs before the age of 54. The first 401(k) program was implemented in 1981, and by the year 2000, more than three-fourths of American workers were participating in a 401(k). Those reaching retirement age in recent years were among the early participants in these accounts.2,3

The more accounts you acquire over your working life, the more challenging it can be to keep track of them all. You also may have moved several times throughout the years, making it difficult for plan administrators to contact you. If accounts are left unattended for a period of time, they can be transferred to the state as unclaimed property.2

If you believe you have a lost 401(k), there are several ways to locate and retrieve it:

Contact Former Employers—Reach out to your previous employers’ human resources or benefits department. They might be able to provide information about 401(k) accounts and help you access information on them.

Consult the Plan Administrator—Your former employer may no longer be in business. If so, consider contacting the financial institution that you believe was managing your 401(k). If the financial institution is still connected to the plan, they may be able to provide information on your account status.

Review Old Financial Documents—Look for any past financial statements or documents you may have from a former employer. These may contain details about your accounts, including account numbers and the plan administrator’s contact information.

Call the Department of Labor—The U.S. Department of Labor Employee Benefit Services Administration (EBSA) has a team of ERISA Benefit Advisors who help individuals locate retirement accounts from previous employers. There are 13 regional EBSA offices located around the country.4

Use Online Databases—Several online resources can assist in locating lost 401(k) accounts, including:5

- National Registry of Unclaimed Retirement Benefits—Not every company that offers 401(k)s will be registered here, but many are. You’ll have to provide your Social Security number to begin your search.

- Department of Labor’s abandoned plan database—If a previous employer who is no longer in business had a 401(k), this database may be able to find it.

- FreeERISA—This website specializes in employee benefit data. You can search for employee benefit and retirement plan filings by location.

- U.S. Pension Guaranty Corp. database of unclaimed pensions—You’ll be asked to provide your name, address, contact information, Social Security number, employer name, and the dates you worked for the company.

- MissingMoney.com—This website is run by states and the National Association of Unclaimed Property Administrators (NAUPA). If your 401(k) no longer exists, the money may have wound up in a state’s unclaimed property fund. You type in your first and last name, city, and state and see what comes up. Even if you don’t turn up an old 401(k) account, you might find money from another source, such as an insurance claim or money that a bank owes you.

- Check State Unclaimed Property Databases—If your 401(k) funds were turned over to state unclaimed property agencies, you can search their database to help you locate these funds.

SECURE 2.0 Lost & Found Coming Soon

The landmark retirement reform legislation called the SECURE 2.0 Act ushered in various provisions designed to make saving for retirement easier and more effective.

Among the retirement challenges identified by the lawmakers were the increasing mobility of today’s workforce and the proliferation of 401(k)s. As individuals change jobs today at a much higher rate than in generations past, Congress acknowledged that many accounts get lost in the transition when people change jobs.

For this reason, the SECURE 2.0 Act directs the Department of Labor (DOL) to create a searchable retirement plan database to assist individuals in locating and retrieving accounts associated with former employers. SECURE 2.0 will establish a new searchable database on the DOL website to look for lost retirement savings accounts. Individual companies are in the process of populating this database, so look for it to be another option to find lost 401(k)s shortly.6

What to do when you find an old 401(k)?

If you have questions about finding or managing your old 401(k)s, we’re here to help. Our expertise extends beyond tracking down accounts; we can also assist in creating an integrated strategy that aligns with your goals to help all assets work together effectively. Additionally, it’s wise to review beneficiaries on old accounts to determine if they reflect your current wishes. Connect with us, and let’s help so that no stone is left unturned in your retirement.

Sources:

1. Capitalize, June 23, 2023. Once you reach age 73, you must begin taking required minimum distributions (RMDs) from your 401(k) or any other defined contribution plan in most circumstances. Withdrawals from your 401(k) or any other defined contribution plans are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. https://www.hicapitalize.com/resources/the-true-cost-of-forgotten-401ks/

2. Charles Schwab, August 22, 2023

https://www.schwab.com/learn/story/tracking-down-lost-401k

3. Britannica Money, October 12, 2024

https://www.britannica.com/money/401k

4. U.S. Department of Labor, November 11, 2024

https://www.dol.gov/agencies/ebsa/about-ebsa/about-us/regional-offices

5. Smart Assets, September 6, 2024

https://smartasset.com/retirement/how-to-find-old-401k-accounts

6. ThinkAdvisor.com, July 1, 2024

https://www.thinkadvisor.com/2024/07/01/more-secure-2-0-act-provisions-are-coming/