Blog

Navigating Healthcare Costs in Retirement: Life After Employer-Sponsored Health Insurance

As you approach retirement, a critical aspect of your retirement strategy can catch even the most financially savvy individuals off guard: healthcare costs. For decades, you may have enjoyed employer-sponsored health insurance. As retirement looms, you're about to...

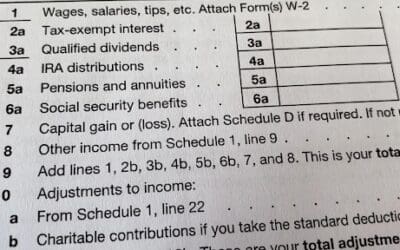

IRS announced its new inflation-adjusted tax brackets for 2025

On Tuesday, the IRS announced its new inflation-adjusted tax brackets for 2025. The annual income thresholds rose by about 2.8% from 2024—the smallest jump in several years. The IRS each fall announces inflation-adjusted changes to the tax brackets and dozens of...

A Different Kind of Year-End Review: 10 Steps to Reflect and Recharge

Financial professionals typically have a year-round focus on monetary goals and wealth management strategies. However, we also believe that true financial well-being is intrinsically linked to your overall life satisfaction and personal growth. This year, we're...

Year-End Giving Strategies: Maximizing Your Impact

America is a generous country. People with diverse backgrounds can unite for a good cause, whether to benefit their local communities or the broader world. As we enter the holiday season, now is a great time to think about your giving strategy and your contributions...

Exploring the Financial Impact of Electric Vehicles

As financial professionals, we’ve noticed a trend among our clients: an increasing interest in electric vehicles (EVs). To help address some of your questions, we’ve compiled this high-level guide to provide insights into the financial aspects of owning an electric...

Safeguarding Your Identity: Essential Tips for Financial Security

Statistics show that nearly 33% of Americans have faced some identity theft attempts in their lives, and experts estimate there is a new case of identity theft every 22 seconds. As financial professionals, one of our primary goals is to help our clients create a...

The Impact of Elections on the Markets and Tax Policy

The Impact of Elections on the Markets and Tax Policy With Labor Day behind us, we're in the final stretch of the 2024 presidential election race. As we follow the news and parse the most recent polls, some may ask, "How might what happens on November 5 impact my...

Don’t Be A Victim Of The Retirement Crisis

If you think the United States has a retirement crisis, you are not alone. A recent survey found that 79% of working-age Americans believe the same thing. That percentage is up from 67% in 2020. When asked about their situation, more than half of Americans (55%) are...

Artificial Intelligence’s Influence on the Investing Landscape

In 1999, Bill Gates wrote, “How you gather, manage, and use information will determine whether you win or lose.” Companies looking to be successful in the future should heed these words when making decisions about implementing artificial intelligence (AI) across their...

Will your money last as long as you do?

Don’t let a lack of income derail your retirement!

In This Free Guide, You’ll Learn…

How an experienced financial professional can help you address you “what ifs” about retirement.

In 1984, the average American household spent $2,500 per person annually on health care. In 2018, that number was $5,000. That means costs are 100% higher than they were in 1984.

The right questions to ask about retirement, like: “How do I make sure my money lasts?” and “How do I cover all my expenses?”

Ready to find out why a Retirement Income Analysis matters for your future? Get your instant download!

Receive your instant download!

Enter your information below to instantly download the guide.