Blog

The Majority of 401(k) Plans Underperform Cheaper Options, a Study Finds

The overwhelming majority of 401(k) plans have underperformed cheaper alternatives over the past decade, according to an analysis by Abernathy Daley 401 (k) Consultants, an administrator of corporate retirement plans. This trend is bound to continue unless substantive...

The Essential Documents Every Family Should Have (and Why They Matter)

We plan vacations, birthday parties, and even weekly dinners—but too often, we put off planning for the unexpected. The truth is, having your estate planning essentials in place is one of the most loving things you can do for your family. Whether you’re starting a...

Mid-Year Financial Checkup: 5 Smart Moves to Stay on Track in 2025

The halfway point of the year is the perfect time to pause, evaluate, and adjust your financial plan. Whether you're preparing for retirement or just getting started on your savings journey, a mid-year financial checkup ensures you're not leaving opportunities—or...

How to Turn Your Retirement Savings Into Reliable Income in 2025

You’ve spent years building your retirement nest egg—saving diligently, investing wisely, and contributing to accounts like your 401(k), IRA, or Roth IRA. But how do you turn those savings into a sustainable income stream once the paychecks stop? This is one of the...

“The Four Most Dangerous Words in Investing Are: ‘This Time It’s Different.’” – Sir John Templeton

Despite the noise, history often rhymes. Here's why sticking to proven investment principles may still be your best strategy in 2025. Why “This Time It’s Different” Can Be Costly Sir John Templeton famously warned: “The four most dangerous words in investing are:...

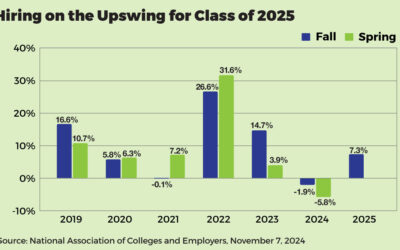

What’s the Job Market Look Like for 2025 Graduates?

It’s graduation season—a time of celebration and new beginnings. For families with college seniors, this time can bring both excitement and uncertainty. While some graduates have jobs lined up, many others still are navigating job searches anxiously. The main reasons...

Is It Smarter to Buy or Rent a Second Home?

As summer approaches, your thoughts may drift toward escaping your daily routine. Whether your idea of a perfect vacation is sitting on a pristine beach, fishing in a mountain lake, or playing the back nine between pickleball matches, many of our clients have come to...

April is National Financial Literacy Month: A Call to Empowerment and Prosperity

April marks National Financial Literacy Month, an important reminder of the critical role that financial literacy plays in safeguarding both personal well-being and our nation’s economic health. At Phoenix Financial Group, LLC, we believe that promoting financial...

Layin’ It on the Line: Why retirees are moving to fixed index annuities in 2025

Retirement planning has evolved, and in 2025, more retirees than ever are turning to fixed index annuities, or FIAs, to protect their savings while securing a steady income. With market uncertainty, inflation concerns, and longevity risks on the rise, FIAs offer a...

Will your money last as long as you do?

Don’t let a lack of income derail your retirement!

In This Free Guide, You’ll Learn…

How an experienced financial professional can help you address you “what ifs” about retirement.

In 1984, the average American household spent $2,500 per person annually on health care. In 2018, that number was $5,000. That means costs are 100% higher than they were in 1984.

The right questions to ask about retirement, like: “How do I make sure my money lasts?” and “How do I cover all my expenses?”

Ready to find out why a Retirement Income Analysis matters for your future? Get your instant download!

Receive your instant download!

Enter your information below to instantly download the guide.