Blog

Helping Adult Children Buy a Home: How to Gift a Down Payment The Smart Way

Key Takeaways Here are some questions this blog aims to answer: How can parents or grandparents help with a down payment for adult children? What are ways to gift a down payment, and how do the annual gift tax exclusion and lifetime estate exemption work? Should you...

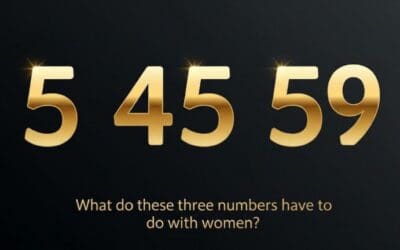

Three Numbers Every Woman Should Know

Three Numbers Every Woman Should Know Key Takeaways How much wealth are women on track to control in the next decade, and why does that matter? What does the life expectancy gap between women and men mean for how long money needs to last? How common is it for women to...

Tax Prep vs. Tax Strategy: The Difference Matters More Than You Think

Key Takeaways Treat tax strategy as a continuous process, not a once-a-year filing exercise. Coordinate with financial and tax professionals throughout the year to identify opportunities for efficiency. Review contribution limits, charitable rules, and estate...

Understanding The Emotions Behind Financial Decisions

Key Takeaways Emotions and biases might influence financial choices more often than most people realize. Behavioral patterns, such as loss aversion, familiarity bias, and herd mentality, can impact long-term results. Recognizing emotional triggers can help manage...

Goal Setting That Sticks: Simple Ways to Turn January Motivation into Lasting Wins

Key Takeaways and Suggestions for Successful Goal Setting Use SMART Goals for Clarity and FocusSet goals that are Specific, Measurable, Achievable, Relevant, and Time-bound. This proven method helps break big ambitions into manageable steps, keeps you focused,...

Year-End Giving Strategies: Tax-Smart and Impactful

Key Takeaways A third of annual donations: About one-third of all charitable contributions are made in December. Donating before December 31 may offer tax advantages. New rules starting in 2026 (via the OBBB Act) may affect deductions for high earners and...

The True Costs of Caring for Aging Parents

Caring for aging parents is one of the most profound acts of love a person can give. But it is also one of the most demanding, emotionally, physically, and financially. Whether you are already in this role or just beginning to prepare, understanding the true costs of...

Money Talks: How to Use Holiday Gatherings to Start Family Financial Conversations

Key Takeaways The holidays are a great time to start important family financial discussions. Discuss your financial situation, estate strategy, and legal preparations with adult children. Make sure your loved ones know your income sources, account access, and...

Should You Pay Off Your Mortgage Early or Invest Instead?

Got a bonus, inheritance, or extra income? One big financial question often follows: 👉 Should I pay off my mortgage early, or invest the money instead? At first glance, it might feel like a simple choice. Paying off your mortgage can free up monthly expenses, while...

Will your money last as long as you do?

Don’t let a lack of income derail your retirement!

In This Free Guide, You’ll Learn…

How an experienced financial professional can help you address you “what ifs” about retirement.

In 1984, the average American household spent $2,500 per person annually on health care. In 2018, that number was $5,000. That means costs are 100% higher than they were in 1984.

The right questions to ask about retirement, like: “How do I make sure my money lasts?” and “How do I cover all my expenses?”

Ready to find out why a Retirement Income Analysis matters for your future? Get your instant download!

Receive your instant download!

Enter your information below to instantly download the guide.