Tax season brings a new wave of identity theft risks, with criminals ready to exploit your personal data to file fraudulent tax returns in your name. Imagine the shock of discovering that a criminal beat you to filing your taxes—potentially reaping your refund or creating serious headaches with the Internal Revenue Service (IRS). Unfortunately, this scenario is becoming increasingly common and serves as a stark reminder of why vigilance is essential.

A Growing Threat

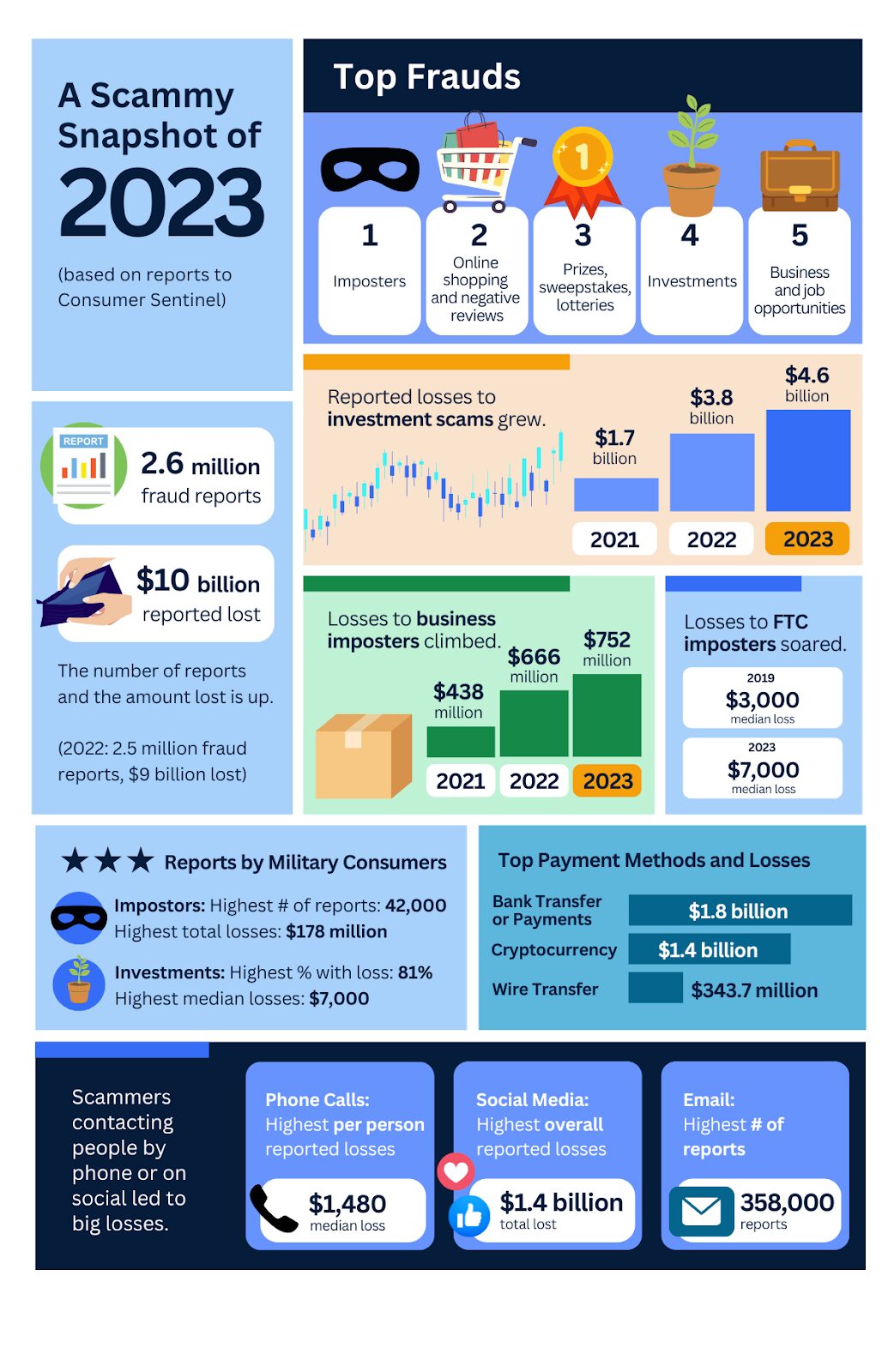

In recent years, tax-related identity theft has grown more sophisticated. The Federal Trade Commission (FTC) reported that individuals lost over $10 billion to fraud in 2023—a 14% increase from the previous year—with over 2.6 million consumers falling victim. Impostor scams, including fraudsters pretending to be IRS officials, employ various tactics to steal sensitive personal and financial information.1

Recent data breaches, such as the massive leak at National Public Data, have exacerbated this issue by exposing millions of taxpayer identification numbers, giving scammers more opportunities to file fake returns early and claim refunds before legitimate taxpayers can file.

We provided this update for informational purposes only and to remind everyone that it’s not a replacement for real-life advice. If you are concerned that your tax filing has been compromised or fear that it could be in the future, we encourage you to consult with your tax, legal, or accounting professionals about specific steps you can take to manage your situation proactively.

Filing Early Could Be A Good Idea

In an example reported by the IRS, a common tactic involves fraudsters exploiting stolen Social Security numbers to file fraudulent tax returns and claim refunds before the legitimate taxpayer can file. This type of tax identity theft can create serious complications for taxpayers, including delays in receiving their rightful refunds and triggering a complex process with the IRS to correct the fraudulent return.

Criminals often seek to maximize their ill-gotten gains by claiming false credits or deductions, which can make the scheme appear more legitimate. The IRS encourages taxpayers to file their tax returns as early as possible to combat this type of fraud. By submitting your return promptly, the IRS says you create a smaller window for fraudsters to act. 2

The IRS has enhanced its security protocols and fraud detection systems to help identify suspicious activities. For example, the agency employs filters to detect anomalies and has programs to help victims of tax-related identity theft restore their accounts and receive legitimate refunds. Still, early filing can be a critical step for taxpayers to protect themselves.3

Other Common Tactics Used by Fraudsters

Tax scams often involve criminals impersonating IRS officials and using intimidation, misinformation, and digital tricks to extract money or data. Be alert to these tactics:

- False Promises of Refunds—Unsolicited messages or calls claiming you qualify for a refund or tax credit can be a ploy to steal your data.

- Aggressive Threats—Fraudsters may use threats of arrest, deportation, or other legal consequences to pressure victims into compliance.

- Suspicious Links—Be wary of emails containing questionable links that redirect to fraudulent websites designed to imitate the official IRS site.

- Gift Card Demands—Some scammers may instruct victims to make payments using gift cards, a common tactic to avoid traceable transactions. This is a clear red flag, as legitimate agencies, including the IRS, do not accept gift card payments.

- Phishing Emails and Texts—Phishing attacks often appear to come from trusted sources, including financial institutions or the IRS itself, and may request sensitive personal information such as your Social Security number or banking details. The IRS has warned taxpayers to be vigilant about phishing schemes, with scams often increasing during tax season or around economic relief packages.

Dirty Dozen Tax Scams

Compiled annually, the Dirty Dozen lists a variety of common scams that taxpayers may encounter anytime but many of these schemes peak during filing season as people prepare their returns or hire someone to help with their taxes. Here is their list from 2024.2

- Fake Charities—Fraudsters may solicit donations for bogus charities, especially in the wake of natural disasters or major crises, to steal money and personal information.

- Fraudulent Tax Preparers—Some unscrupulous tax preparers file false returns, charge inflated fees, or encourage taxpayers to claim improper credits or deductions. Be wary of preparers who refuse to sign the return, known as “ghost preparers.”

- Offer in Compromise Mills—Scammers may promise to settle tax debts for “pennies on the dollar” through the IRS Offer in Compromise program but often mislead victims or charge exorbitant fees. Taxpayers can verify eligibility using the IRS Offer in Compromise Pre-Qualifier Tool.

- Social Media Scams—Fraudsters exploit social media by promoting false tax refund schemes, spreading bad advice on submitting tax returns, and more.

- Unemployment Fraud—Criminals file fake unemployment benefit claims using stolen personal information, creating complications for victims when filing taxes.

Understanding how the IRS operates can help you spot scams

You can help protect yourself from these types of scams by better understanding how the IRS legitimately interacts with taxpayers:2

- Mail First—The IRS usually initiates contact via U.S. mail, not through unsolicited emails or phone calls.

- Email follow-up—The IRS will not email you without prior consent.

- No Social Media Direct Messages—You will not receive outreach from IRS representatives on social platforms.

- Phone Calls—Rare and typically follow written communication.

- In-Person Visits—The IRS may visit for unpaid taxes or audits, which are usually preceded by multiple written notices. According to the IRS, in-person visits are limited to specific cases and always include official IRS credentials. Taxpayers have the right to request a confirming notice and call the IRS directly to verify legitimacy.

Five Steps to Help Manage Your Risk

- Take IRS Notices Seriously—Carefully review any correspondence from the IRS and verify its legitimacy. A tax professional may be able to help.

- Beware of Phishing Scams—Be cautious of emails or calls claiming to be from the IRS. Verify the authenticity of the information before providing any personal information. Look out for grammatical errors, generic greetings, and requests for immediate action, as these are often hallmarks of phishing attempts.

- Monitor Your Financial Accounts—Regularly check your bank and credit accounts for suspicious activity, especially during tax season.

- Enhance Online Security—To protect sensitive information, Use strong, unique passwords, enable multi-factor authentication, and change passwords regularly. Consider using password managers to maintain complex and varied passwords for each of your key accounts.

- Utilize Monitoring Solutions—Taxpayers can use the IRS’s “Get Transcript” online service to view their account history, which can help spot discrepancies or unauthorized actions (https://www.irs.gov/individuals/get-transcript).

What to Do if You’re Targeted

If you suspect you’re a victim of tax return fraud, it’s essential to act quickly:

- Contact the IRS – Use the Identity Theft Hotline at 1-800-908-4490 and follow their guidance.

- File an Identity Theft Affidavit – Submit Form 14039 to notify the IRS of potential identity theft.

- Monitor Your Credit – Contact the major credit bureaus to place a fraud alert or security freeze on your credit report.

- Work with Your Tax Professional – They can help guide you through the process and, in some instances, speak to the IRS on your behalf.

Conclusion

With identity theft and tax scams on the rise, you need to use all the resources to help protect yourself. Your top resource is your common sense.

If something doesn’t seem right, it may not be. Don’t be intimidated by someone claiming to be from the IRS. As a government agency, they have procedures and processes that must be followed. If you are being contacted by someone who seems suspicious, disengage immediately and contact the IRS directly. Your tax professional is also there to help. If you do not have a tax professional, please let us know. We work with several of them in your area who may be able to offer some insight.

For more information, consider visiting the IRS Tax Scams page https://www.irs.gov/help/tax-scams/recognize-tax-scams-and-fraud, or explore resources like the FTC’s Consumer Protection updates.

Sources:

1. Federal Trade Commission, February 9, 2024

2. Internal Revenue Service, November 2024

https://www.irs.gov/help/tax-scams/recognize-tax-scams-and-fraud

3. Internal Revenue Service, November 2024

https://www.irs.gov/newsroom/how-to-know-if-its-really-the-irs